Summary:

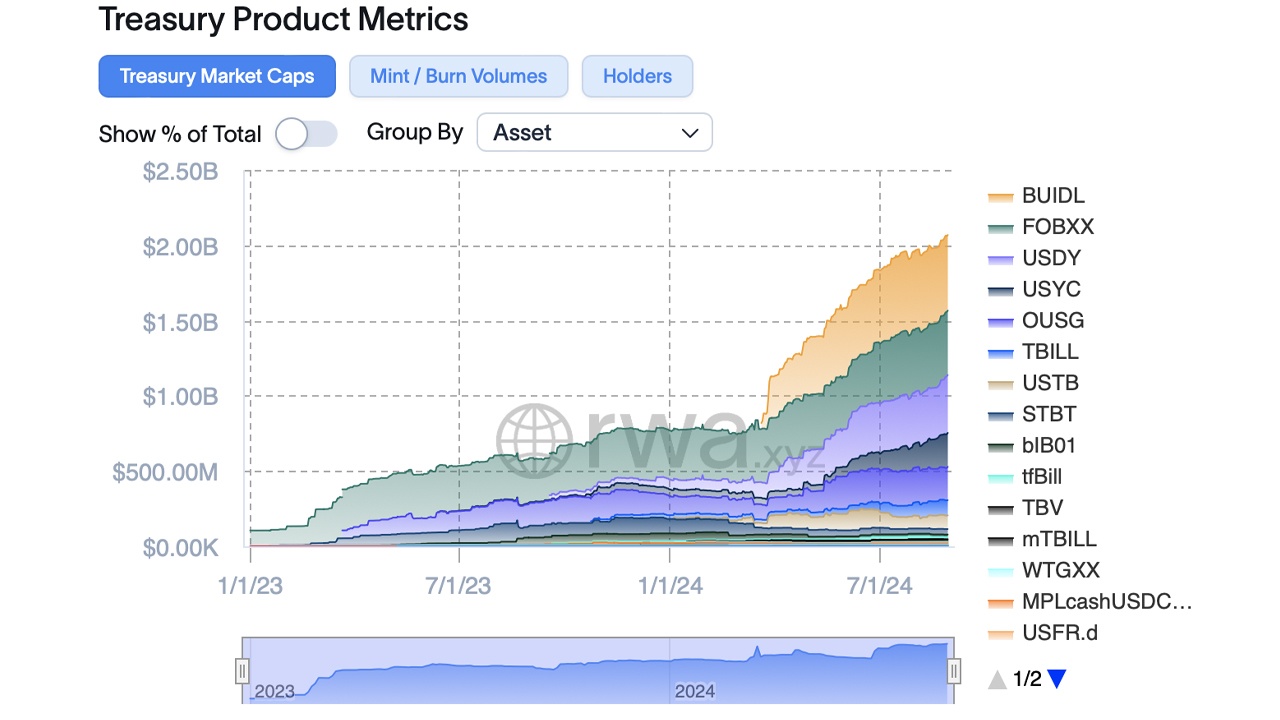

U.S. Treasury bond-backed token economy surpasses $2 billion in value.

Blackrock and Franklin Templeton lead with a 44.95% share.

1,872% growth in tokenized market since January 2023.

$1.5 billion minted on the Ethereum blockchain.

Experts predict limitless potential for tokenized real-world assets (RWAs).

The U.S. Treasury bond-backed token economy has recently crossed a significant milestone, now exceeding $2 billion in value. Among the various projects contributing to this total, Blackrock and Franklin Templeton’s tokenized funds stand out, commanding a dominant 44.95% share of the net value.

Tokenized Bond Market Breaks $2 Billion Barrier, With Ondo, Blackrock, and Franklin Templeton at the Forefront

As August wraps up, the combined value of tokenized U.S. Treasuries, bonds, and cash-equivalents has hit an impressive $2.07 billion. Since January 1, 2023, this market has expanded by over 1,872%, leaping from $104.93 million to its present level. According to rwa.xyz, the frontrunner in this space is Blackrock’s USD Institutional Digital Liquidity Fund (BUIDL), boasting a current market cap of approximately $502.54 million, based on archived data.

Franklin Templeton’s Onchain U.S. Government Money Fund, commonly known as BENJI, boasts a market cap of $427.94 million. Close on its heels, Ondo’s U.S. Dollar Yield project holds $384.45 million, followed by Hashnote’s Short Duration Yield Coin with $225.64 million, and Ondo’s Short Term U.S. Government Bond Fund at $221.26 million. Of the $2.07 billion in total value, a substantial $1.5 billion is minted on the Ethereum blockchain.

Stellar holds $437.6 million, while Solana accounts for $60.6 million. Although Blackrock’s and Franklin Templeton’s funds lead in size, Ondo surpasses both with a combined market cap of $605.7 million. Geographically, U.S. tokenized funds dominate with $1.65 billion, followed by $225 million from the Cayman Islands, and $114.05 million from the British Virgin Islands. Other key jurisdictions include Singapore, Switzerland, Germany, and Liechtenstein.

Throughout 2024, the tokenized U.S. Treasury and bond market has experienced rapid expansion, with many experts predicting limitless potential for tokenized real-world assets (RWAs). The concept has already been successfully applied to fiat-pegged tokens and precious metals. Institutional heavyweights such as Blackrock and Franklin Templeton appear confident that blockchain-based crypto assets are carving out a lasting role in finance, hinting at a shift towards more varied and decentralized financial systems.

What do you think about the expansion of the tokenized bond market? Share your thoughts and opinions about this subject in the comments section below.

Comments