Summary:

Eros Biondini introduces a bill for a national Bitcoin reserve in Brazil.

Sovereign Strategic Bitcoin Reserve (RESBit) aims to protect against exchange rate fluctuations.

5% of Brazil's international reserves to be allocated for Bitcoin accumulation.

Management will be handled by the Central Bank of Brazil with transparency measures.

Focus on public education about cryptocurrencies and their growing market value.

In a significant move towards integrating cryptocurrency into Brazil's financial framework, federal deputy Eros Biondini has introduced a bill aimed at establishing a national Bitcoin reserve.

The Sovereign Strategic Bitcoin Reserve (RESBit)

Filed on Monday, the legislation proposes the creation of the Sovereign Strategic Bitcoin Reserve (RESBit), intended to diversify the financial assets of Brazil’s National Treasury. According to Biondini, this initiative aims to protect Brazil’s reserves from exchange rate fluctuations and geopolitical risks, while promoting the adoption of blockchain technology across both public and private sectors. It also aims to provide solid backing for Brazil’s new digital currency, Drex.

Biondini emphasized that establishing RESBit is a strategic measure positioning Brazil at the forefront of the digital economy. He stated, > "The approval of this project is essential to guarantee the country’s economic sovereignty and align Brazil with global innovation trends."

Gradual Bitcoin Accumulation

The bill outlines a gradual approach to acquiring cryptocurrencies, proposing a “gradual Bitcoin accumulation” limited to 5% of Brazil’s international reserves. The management of these assets would be through cold wallets.

Furthermore, any expenditure from the reserve is mandated to comply with Brazil’s Fiscal Responsibility Law, ensuring transparency and accountability through semiannual transaction reporting to the National Congress.

Central Bank's Role

The management of the Bitcoin reserve would fall under the purview of the Central Bank of Brazil (BC), in collaboration with the Ministry of Finance. The bank will also be tasked with developing monitoring and control systems using artificial intelligence and blockchain technologies for operational integrity.

Public Education on Crypto Assets

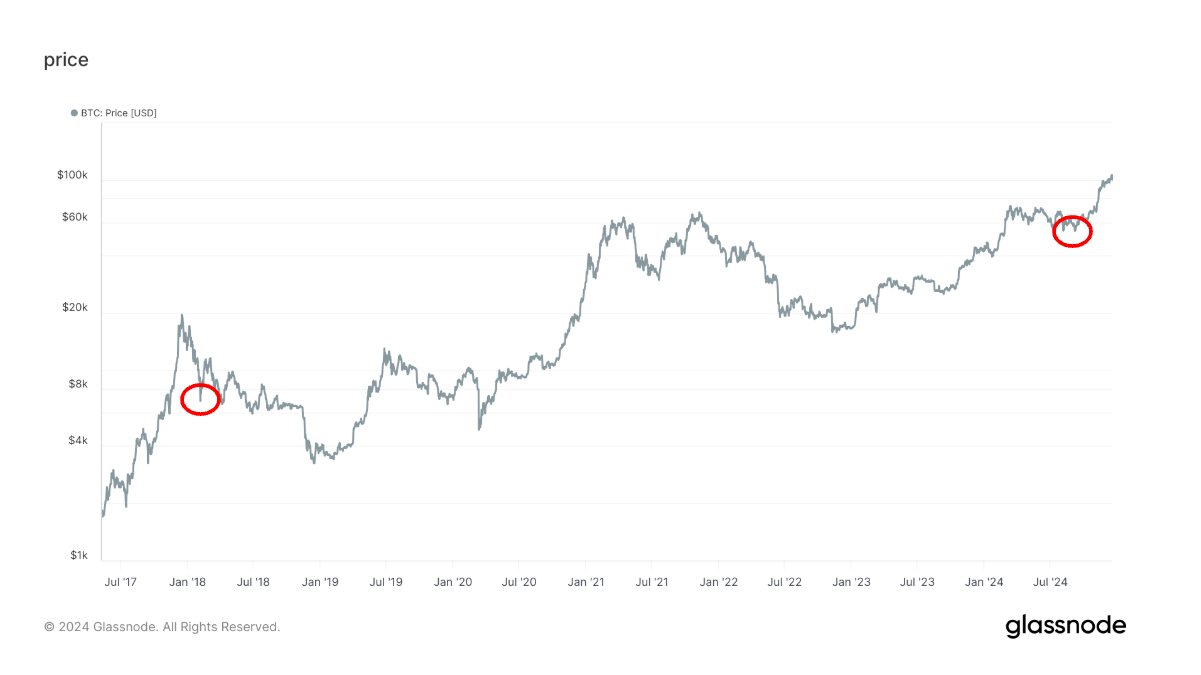

The bill emphasizes the importance of educating the public about crypto assets, recognizing their growing significance in the global financial landscape, which has recently surpassed $3 trillion in market value. Despite the volatility of cryptocurrencies, Biondini argues that they are increasingly being recognized as a legitimate asset class. Countries that adopt effective strategies for economic integration with cryptocurrencies are likely to reap significant benefits in the medium to long term.

As of now, Bitcoin (BTC) trades at $92,620, having corrected 7% over the past four days after nearing the $100,000 mark. However, it remains up 37% over longer time frames.

Comments