Summary:

Bitcoin's volatility is declining, making it a stable investment.

Adding Bitcoin to portfolios can significantly outperform traditional investments.

Bitcoin acts as a hedge against fiat currency decline.

Long-term holding leads to consistently positive returns.

BlackRock's confidence in Bitcoin is shown through its ETF offerings.

BlackRock's Insights on Bitcoin Volatility

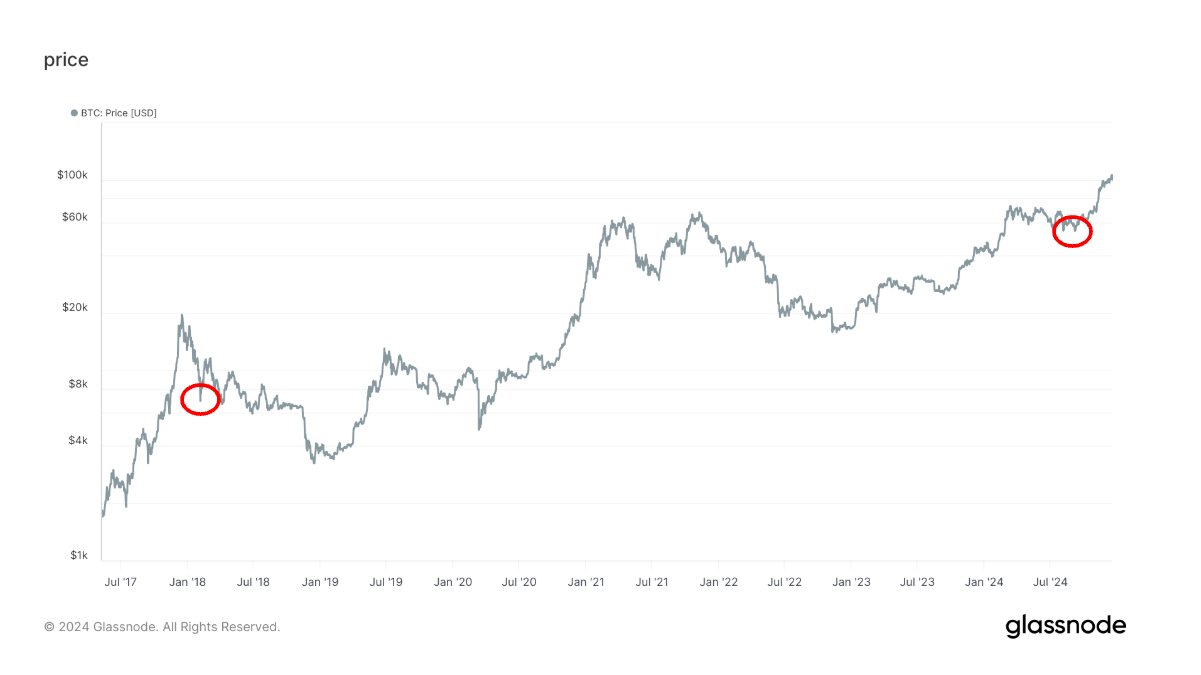

BlackRock, the world’s largest asset manager, has recently made headlines by predicting a continued decline in Bitcoin's volatility, positioning it as a stable long-term investment. During the Digital Assets Conference, BlackRock unveiled its findings, emphasizing that Bitcoin's volatility has been steadily decreasing and is expected to continue this trend as adoption increases and the asset matures.

Key Takeaways

- Bitcoin's Integration: BlackRock's data indicates that adding Bitcoin to investment portfolios can significantly outperform traditional investments.

- Hedge Against Fiat Decline: The firm highlights Bitcoin's growing role as a hedge against the decline of fiat currencies.

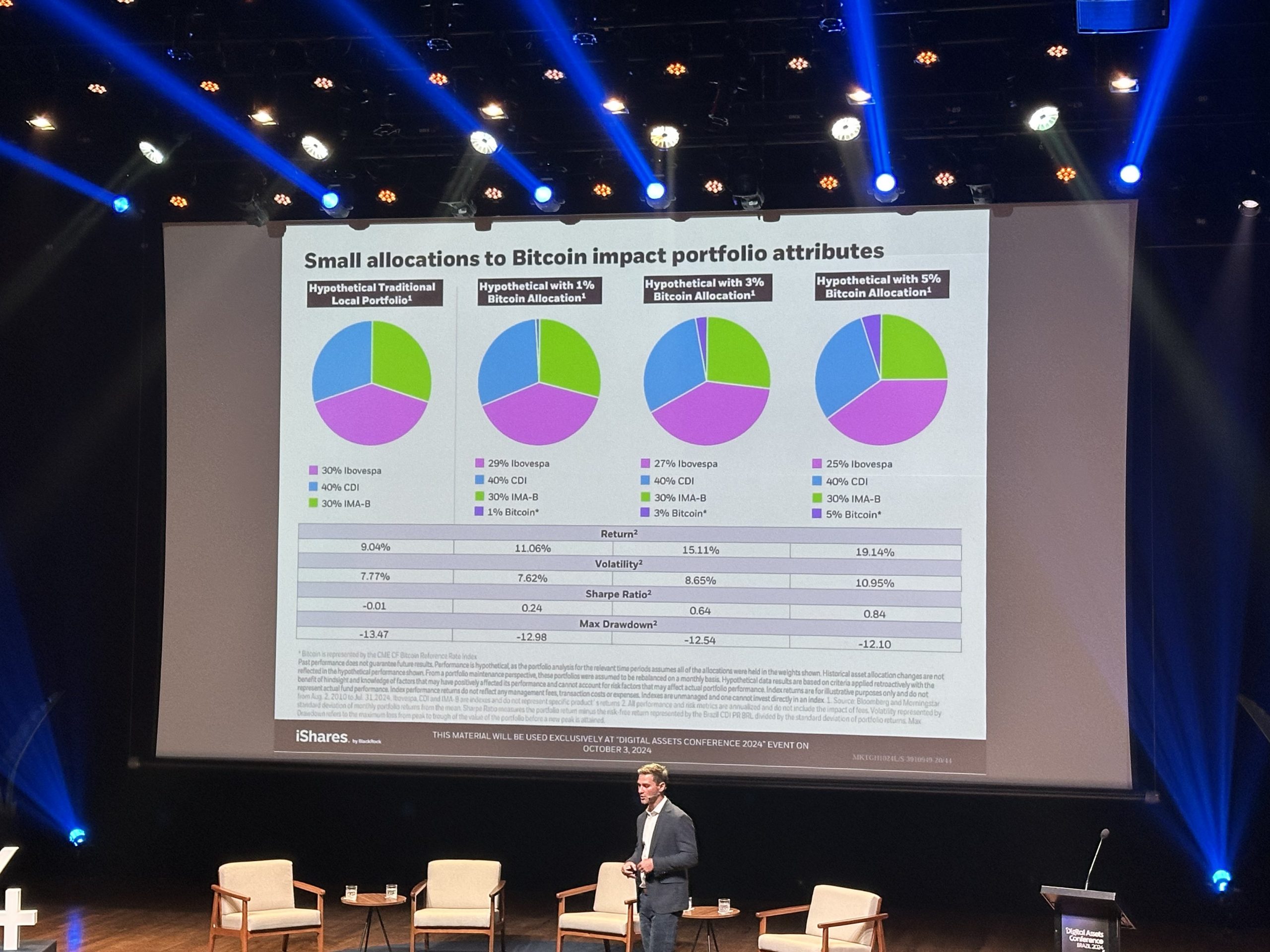

At the conference, BlackRock shared that portfolios incorporating Bitcoin showed improved risk-adjusted returns across various timeframes. For instance, portfolios with 1%, 3%, or 5% Bitcoin allocations yielded higher returns over one, two, five, and ten years compared to traditional portfolios.

While Bitcoin did introduce slight volatility into these portfolios, the potential for higher returns often outweighed the additional risk. A portfolio with a 5% Bitcoin allocation achieved an impressive 19.1% return long-term, significantly surpassing the 11% return from portfolios without Bitcoin exposure.

Long-Term Holding Benefits

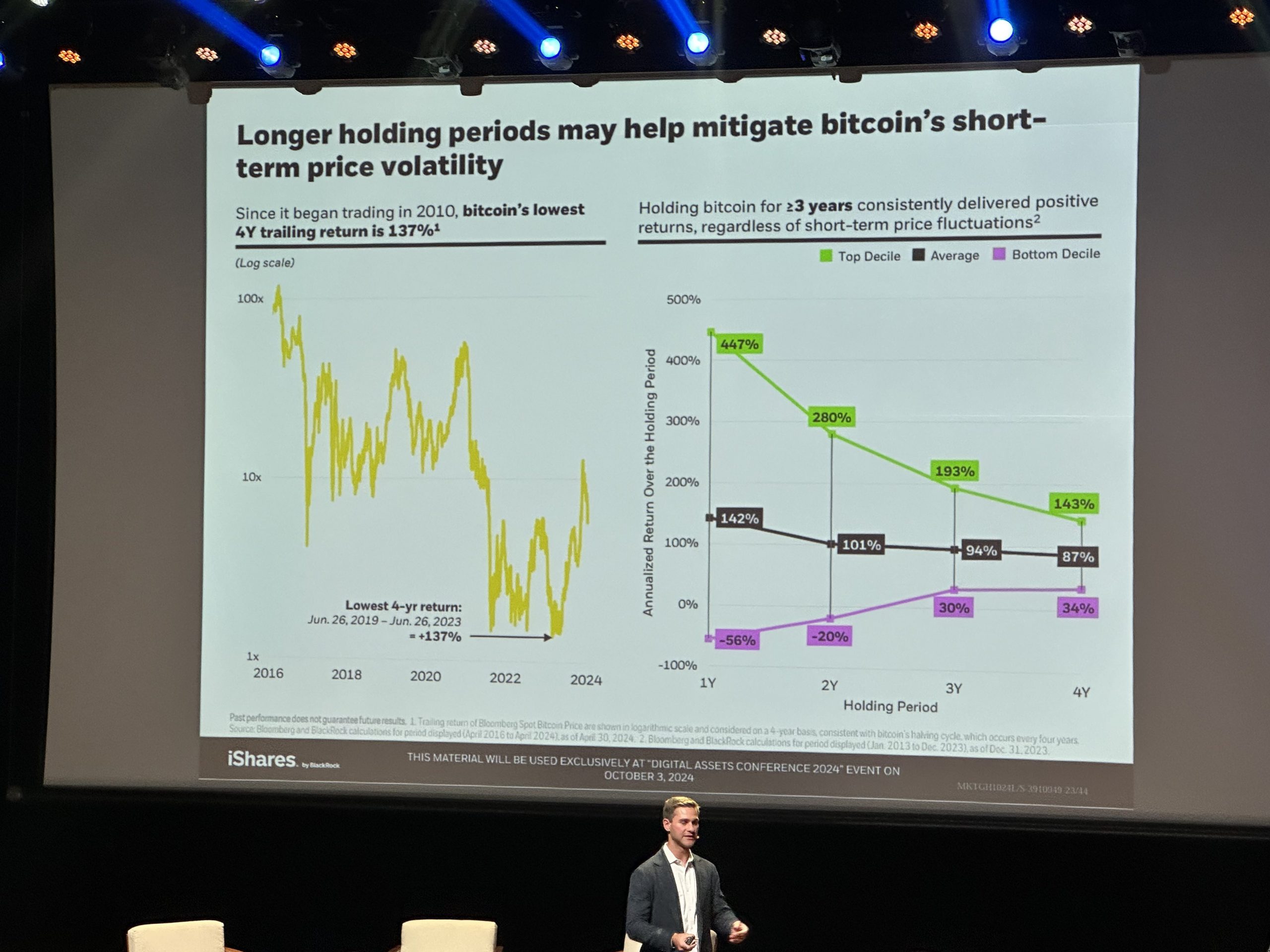

BlackRock emphasized the importance of long-term holding for Bitcoin investments. Their analysis revealed that Bitcoin's lowest four-year trailing return remains an impressive 137%, indicating that holding Bitcoin for three or more years has consistently yielded positive returns.

Additionally, BlackRock compared Bitcoin to gold and US Treasuries, underscoring its fixed supply, decentralized governance, and low correlation with traditional assets, which positions it as a valuable hedge against declining government trust and fiat currencies.

BlackRock also acknowledged that, despite Bitcoin's historically elevated volatility, it has been decreasing as the asset matures. The data revealed a low correlation with gold (0.1) and the S&P 500 (0.2), highlighting Bitcoin's unique role as an independent asset class.

Lastly, BlackRock positioned Bitcoin as a safeguard against the declining value of fiat currencies, particularly the US dollar, which has seen a significant drop since 1913. By offering Bitcoin ETFs, BlackRock is signaling its confidence in Bitcoin's long-term value and its increasing significance in financial markets.

Comments