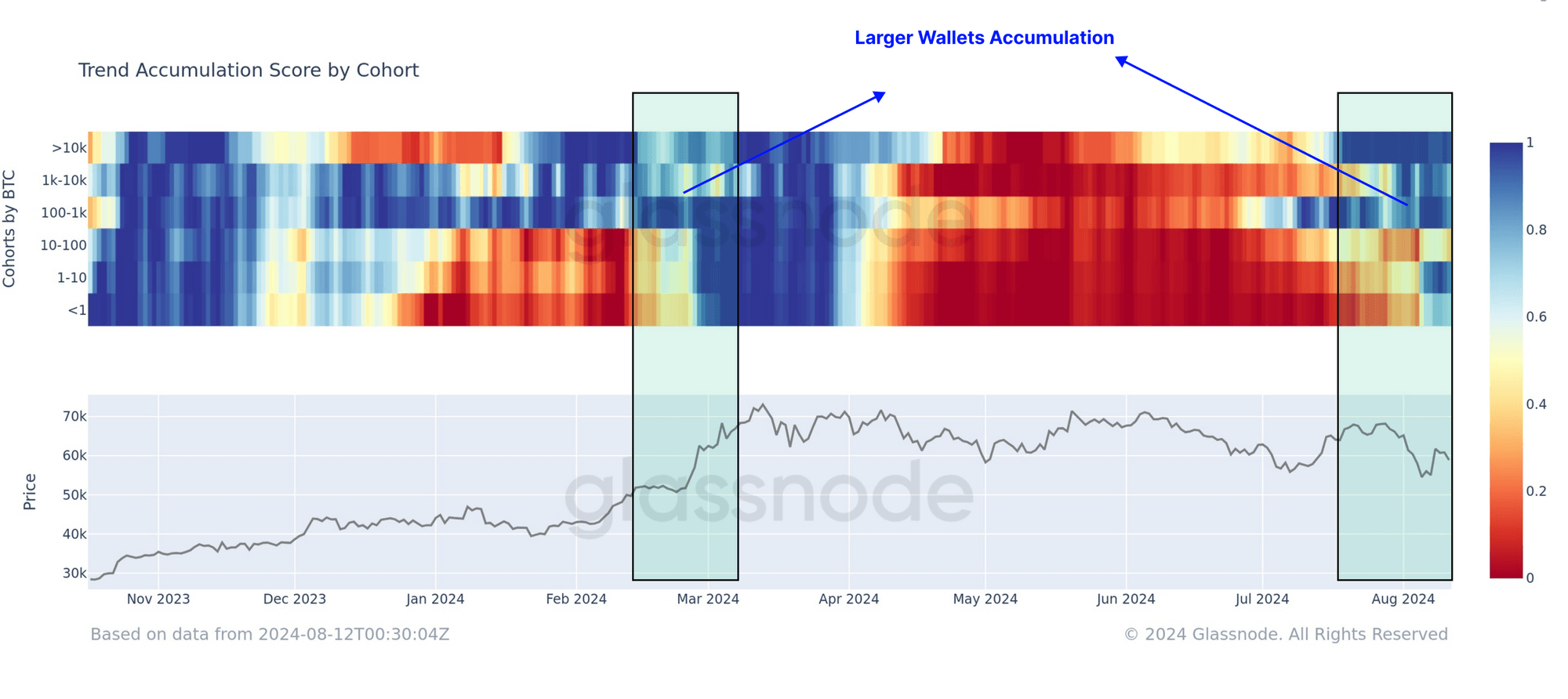

The latest onchain report from Glassnode reveals a significant shift in the bitcoin market, indicating a resurgence in the HODLing behavior among long-term holders despite ongoing volatility. The Accumulation Trend Score (ATS) has reached a maximum value of 1.0, suggesting a strong focus on accumulation.

Renewed Commitment from Bitcoin Holders

According to Glassnode’s analysis, the bitcoin (BTC) market is seeing early signs of a transition from sell-side pressure to accumulation. The report highlights that large wallet sizes, often associated with ETFs, are returning to accumulation.

Source: Glassnode’s weekly onchain report #33.

In the past three months, approximately 374,000 BTC have transitioned back into long-term holding status, indicating that long-term holders (LTHs) are increasingly opting to retain their assets. This shift contributes to a more stable market foundation, as LTHs are showing a preference for holding onto their coins.

Market Indicators and Future Potential

Glassnode's data also points out that the Sell-Side Risk Ratio for LTHs remains low compared to previous cycles, suggesting that these investors are waiting for higher prices before selling. This cautious optimism among long-term investors is reflected in Bitcoin’s recent price movements, with a 2.3% increase on August 13, peaking at $61,600 per unit. Over the past week, BTC has risen more than 7% against the U.S. dollar.

Insights from cryptoquant.com further support Glassnode’s findings, noting a significant influx of bitcoin into long-term holder addresses over the past 30 days.

What are your thoughts on Glassnode’s latest onchain report? Share your opinions below!

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!