Summary:

Bargain-buying period for Bitcoin has ended according to Rekt Capital.

Bitcoin is on the verge of reclaiming its reaccumulation range.

$61,500 is a crucial price point for ongoing upward momentum.

Currently trading at $64,245, indicating a resumed uptrend.

BTC needs to close August above $64,500 to confirm the end of its downtrend.

The End of the Bargain-Buying Period

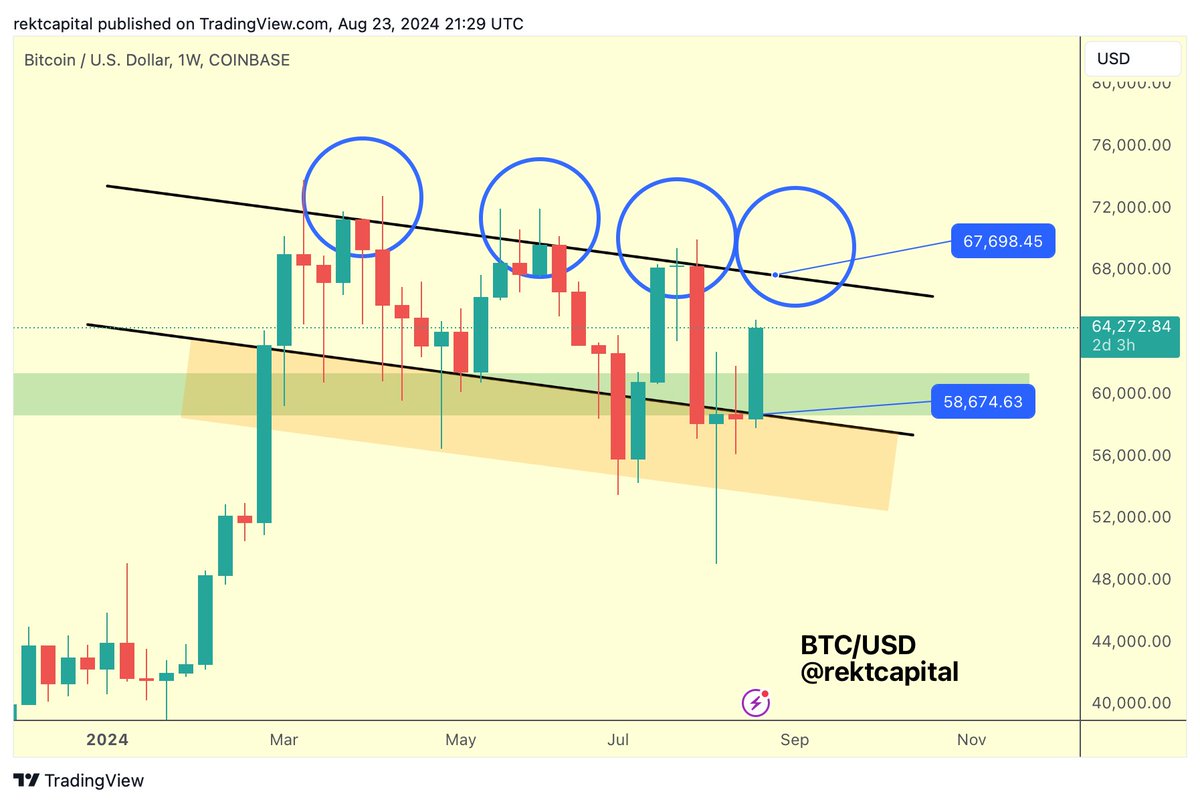

A crypto strategist who accurately predicted this year’s pre-halving Bitcoin correction believes that the time for accumulating discounted BTC is over. Pseudonymous analyst Rekt Capital shared insights with his 494,700 followers on X, indicating that Bitcoin is on the verge of reclaiming its reaccumulation range.

“History has repeated. The downside deviation is over. The bargain-buying period has ended.”

Rekt Capital's analysis shows that Bitcoin has historically demonstrated strength after reclaiming its accumulation range.

Key Price Levels

He emphasizes that Bitcoin is poised to challenge its diagonal resistance, which has kept BTC bearish since March, provided it trades above a crucial price area.

“Week one in the cross-channel ascent likely already underway, provided Bitcoin continues to stay above ~$61,500 going into the new weekly close.”

Currently, Bitcoin is trading at $64,245. Rekt believes that “the uptrend has resumed” for BTC, especially after a recent dip to $48,000 earlier this month.

“We’ll be very lucky if BTC rejects from $71,500 again.”

Looking Ahead

In a broader view, Rekt notes that BTC must close August above $64,500 to confirm the end of its high time frame downtrend.

“Bitcoin is now challenging the series of lower highs on the monthly timeframe... Monthly close a little above current prices and Bitcoin would break the trendline resistance and the downtrend would be over.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should conduct their due diligence before making any high-risk investments in Bitcoin, cryptocurrency, or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility.

Comments