Summary:

Bitcoin whales realized over $1.86 billion in profits recently.

BTC broke through the $60,000 barrier and closed at approximately $63,362.

30,000 BTC were sold by whales in just 96 hours.

The MVRV ratio shows short-term holders averaging a 5% profit.

Over $146 million in short positions were liquidated recently.

Bitcoin's recent performance has sparked optimism in the crypto market, breaking through the $60,000 price barrier and approaching another significant resistance level. This surge has led to substantial profits for whales, with over $1.86 billion realized in just 96 hours.

Bitcoin Whales Take Profit

An analysis of Bitcoin's daily chart revealed that it broke its short-term resistance on September 17, overcoming a 3% gain to reach approximately $60,300. Following this breakout, Bitcoin continued to gain momentum, closing the last trading session at around $63,362. Data from Santiment indicates that over 30,000 BTC were sold by whales during this period.

Despite this sell-off, Bitcoin remains in a bullish trend, supported by a Relative Strength Index (RSI) that has consistently stayed above 60.

Source: TradingView

Source: TradingView

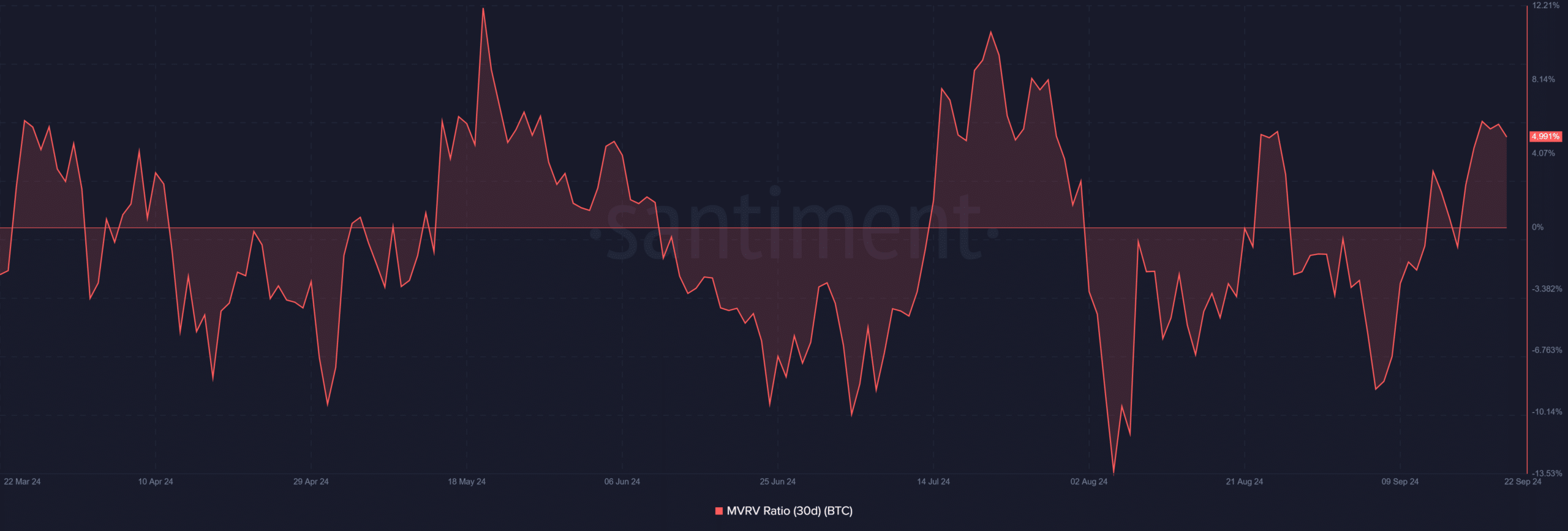

Bitcoin MVRV Shows a 5% Profit

Short-term Bitcoin holders have also benefited from the recent price increase. The 30-day Market Value to Realized Value (MVRV) ratio has crossed above zero as of September 17, currently showing a nearly 5% profit, aligning with the gains realized by whales.

Source: Santiment

Source: Santiment

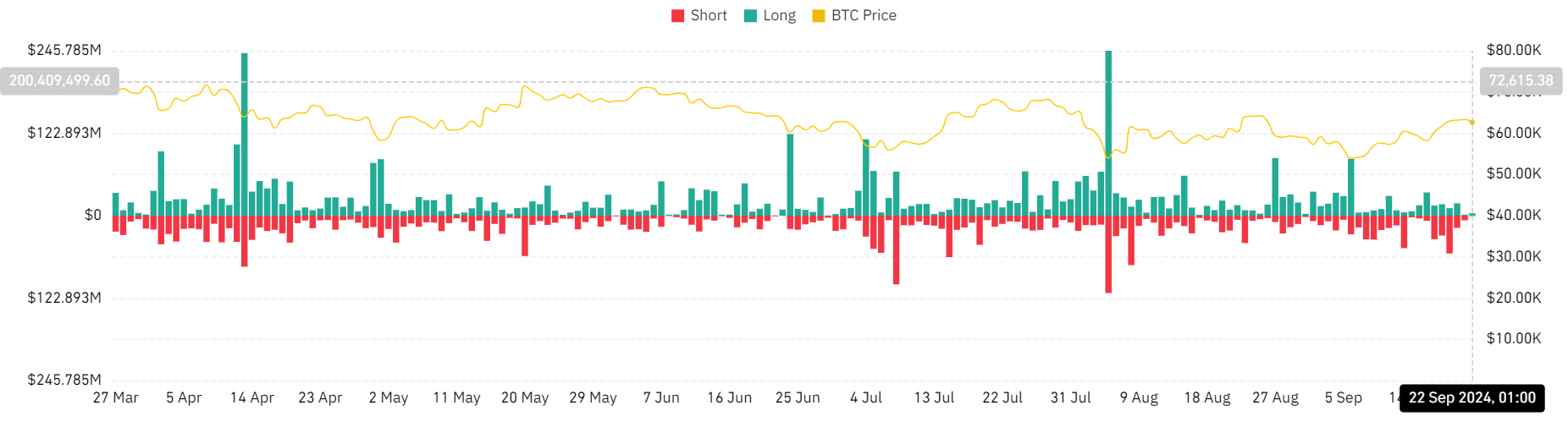

Short Positions Face Increased Liquidations

Since the upward trend began, there has been a significant increase in the liquidation of short positions. Over $146 million worth of short positions were liquidated between September 17 and 21, while long positions experienced around $63 million in liquidations during the same timeframe.

Source: Coinglass

Source: Coinglass

Additionally, the BTC funding rate has remained positive, indicating more buyers are entering the market—an encouraging sign for Bitcoin. This trend may help in absorbing the selling pressure from whales cashing out.

Comments