Summary:

Bitcoin hits new all-time high of $108,135

Crypto market valuation grows by $12.5 billion to $3.73 trillion

Solana and Litecoin also see significant gains

Traders exhibit risk-averse sentiment, favoring Bitcoin over altcoins

Upcoming Fed interest rate decision could impact market dynamics

Crypto Sector Sees Major Growth

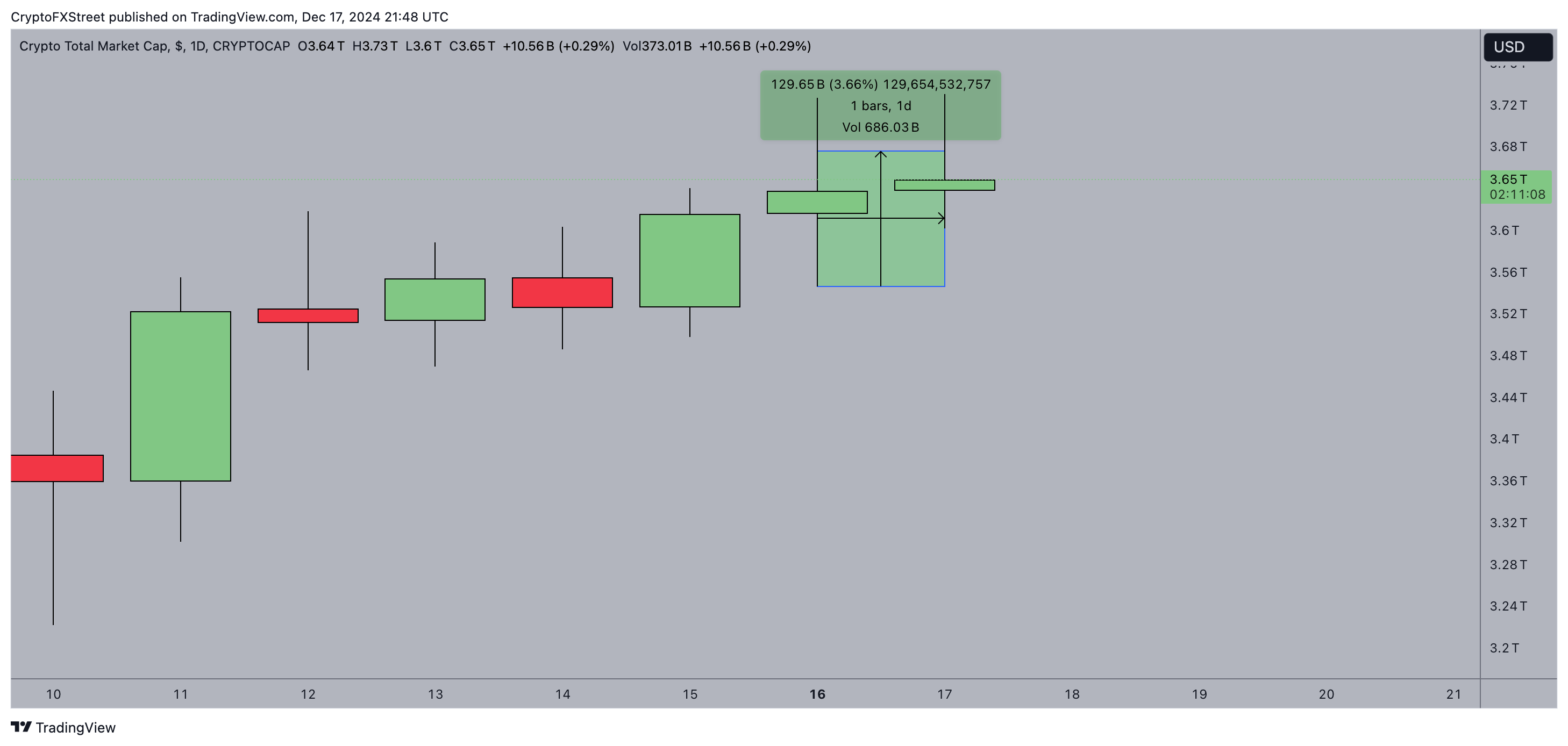

The cryptocurrency sector valuation has skyrocketed by $12.5 billion, reaching a staggering $3.73 trillion on Tuesday. Notably, Bitcoin has achieved a new all-time high of $108,135, alongside significant gains for Ethereum and Solana.

Altcoin Market Updates

As the US Federal Open Market Committee (FOMC) began its last meeting of the year, bullish traders made last-minute bets anticipating a third consecutive rate cut. The crypto sector expanded by 3.7%, adding nearly $130 billion to its global market capitalization.

- Bitcoin (BTC) reached a new all-time high of $108,135.

- Litecoin (LTC), Solana (SOL), and Ripple (XRP) also saw substantial gains.

- Solana surged 4%, fueled by the popularity of the new memecoin Fartcoin (FART), which surpassed a $1 billion market cap.

- Privacy coins like Monero (XMR) and Litecoin gained momentum after US authorities dismantled a North Korean crypto laundering network.

Market Sentiment and Trading Trends

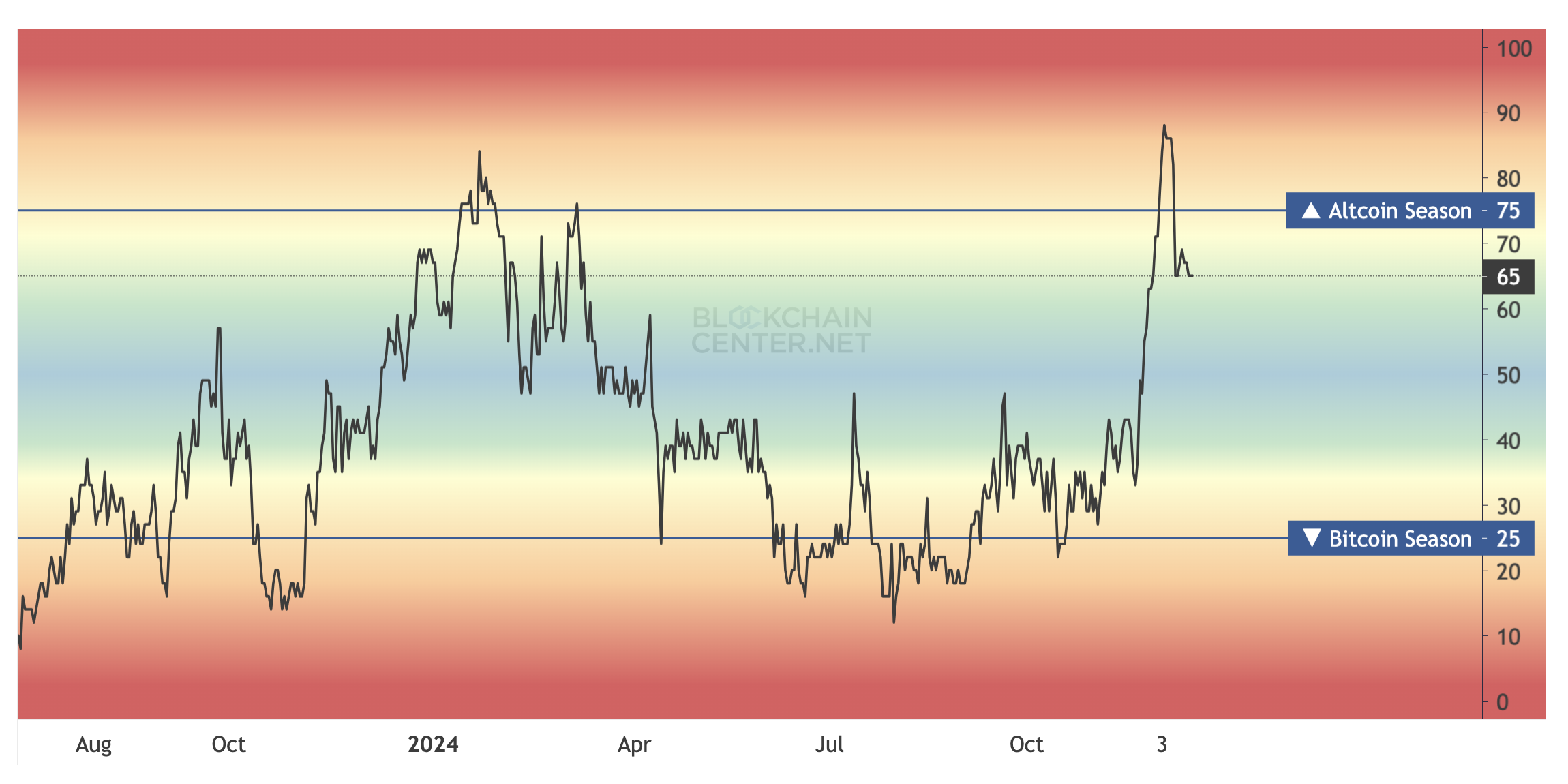

Traders are increasingly risk-averse in light of recent geopolitical tensions. The Altcoin Season Index has dipped from 75 to 65, indicating a 13% decrease in altcoin demand relative to Bitcoin since the market's downturn on December 9. Historically, in times of uncertainty, investors gravitate towards Bitcoin, favoring it over the more volatile altcoins.

The upcoming Fed interest rate decision is highly anticipated, with expectations that a rate cut could rejuvenate investor interest in risk assets and drive capital back into altcoins.

Regulatory Developments

- Bybit plans to cease crypto services in France by January 2025 due to regulatory pressures, impacting French users' ability to withdraw and custody their assets.

- Eliza Labs has partnered with Stanford University to explore the integration of AI in the cryptocurrency space, focusing on trust mechanisms and governance models.

Stay tuned for more updates as the market reacts to the Fed's decisions and regulatory changes.

Comments