Summary:

Bitcoin balances on exchanges have reached historic lows, indicating a supply crunch.

President-elect Donald Trump plans to establish a Bitcoin reserve, boosting investor confidence.

Long-term holders are reducing Bitcoin flow into exchanges, limiting liquidity.

Only three major exchanges have enough Bitcoin reserves to meet demand.

Tightening supply coincides with increasing institutional interest in Bitcoin products.

Historic Low in Bitcoin Exchange Balances

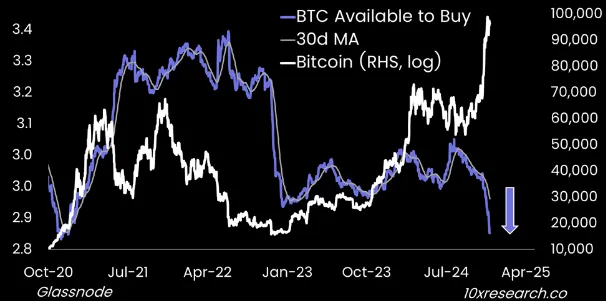

Bitcoin balances on crypto exchanges have plummeted to historic lows, indicating a rapid depletion of available inventory. A recent 10X Research report highlights this trend, showing a sharp drop in the amount of Bitcoin available for purchase.

Contrasting Trends

This depletion starkly contrasts with the inflow observed in late summer when exchange reserves were temporarily replenished. Currently, no such inventory boost has occurred, exacerbating the supply crunch.

Price Surge Driven by Positive Catalysts

The broader crypto market, including Bitcoin, has been buoyed by favorable catalysts suggesting continued growth in the upcoming year. Notably, President-elect Donald Trump has committed to establishing a Bitcoin reserve in the U.S. and protecting crypto mining interests, which has helped elevate Bitcoin's price to record highs near $100,000. This shift has revamped Bitcoin's image as a store of value among investors.

Long-Term Holders and Market Stability

On-chain analytics indicate that long-term holders are firmly maintaining their positions, limiting the flow of Bitcoin into exchanges and reducing liquidity. The attached chart from 10X Research, utilizing Glassnode data, illustrates a clear divergence between Bitcoin's available supply on exchanges and its price.

The blue line represents the 30-day moving average of Bitcoin available to buy, which has plummeted, while Bitcoin's price has surged sharply.

Exchange Liquidity Challenges

Currently, only three major exchanges—Bitfinex, Binance, and Coinbase—report sufficient Bitcoin reserves to meet buyer demand. Smaller exchanges are facing increasing challenges in maintaining liquidity, potentially leading to heightened price volatility.

Macroeconomic Trends and Institutional Interest

The tightening supply coincides with broader macroeconomic trends, including growing institutional interest in Bitcoin-driven financial products such as spot ETFs. This shrinking inventory on exchanges may further drive upward price pressure as demand rises from both retail and institutional players.

Comments