Summary:

Bitcoin reached a new all-time high of $109,340.21.

Mixed reactions from short sellers indicate varying market sentiment.

Total value of short bets on crypto stocks rose to $13.75 billion.

BITF stock shows the most growth potential with over 234% upside.

Decrease in short interest for stocks like Coinbase suggests optimism.

In January, Bitcoin surged to a new all-time high of $109,340.21, igniting both excitement and uncertainty within the cryptocurrency market. This significant milestone led to mixed reactions from investors, particularly those betting against crypto-related stocks, known as short sellers.

Short Interest Dynamics

Some stocks experienced an increase in short interest, while others saw a decrease. Short interest, which indicates how many investors are betting against a stock, can serve as a gauge of market sentiment. Notable stocks with increased short interest included:

- Strategy (MSTR): 10.02%

- CleanSpark (CLSK): 26.48%

- Bitfarms (BITF): 16.15%

- HIVE Digital Technologies (HIVE): 4.20%

Conversely, stocks like Coinbase Global (COIN), Mara Holdings (MARA), Core Scientific (CORZ), and Stronghold Digital Mining (SDIG) experienced a decrease in short interest, suggesting that investors may be growing more optimistic about these companies' prospects.

The total value of short bets on crypto stocks climbed to $13.75 billion in January, up from $12.2 billion the previous month. The leading stocks attracting the most short interest were Strategy, Coinbase, and MARA Holdings, which collectively accounted for $11.56 billion of the total bets. This substantial short interest hints at investor caution regarding the volatility and regulatory uncertainty in the cryptocurrency market. Interestingly, high short interest can sometimes indicate a potential rebound in stock prices.

Which Crypto Stock Is the Better Buy?

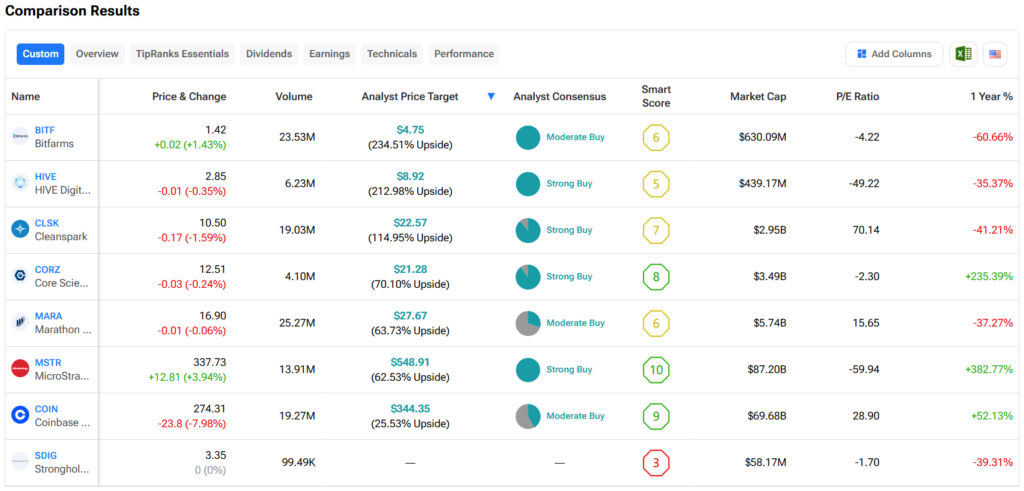

When analyzing the stocks mentioned, analysts believe that BITF has the most room for growth, with an average price target of $4.75 per share, indicating more than 234% upside potential. In contrast, SDIG is expected to perform the least, as it currently lacks an average price target.

Discover more on BITF analyst ratings!

Comments