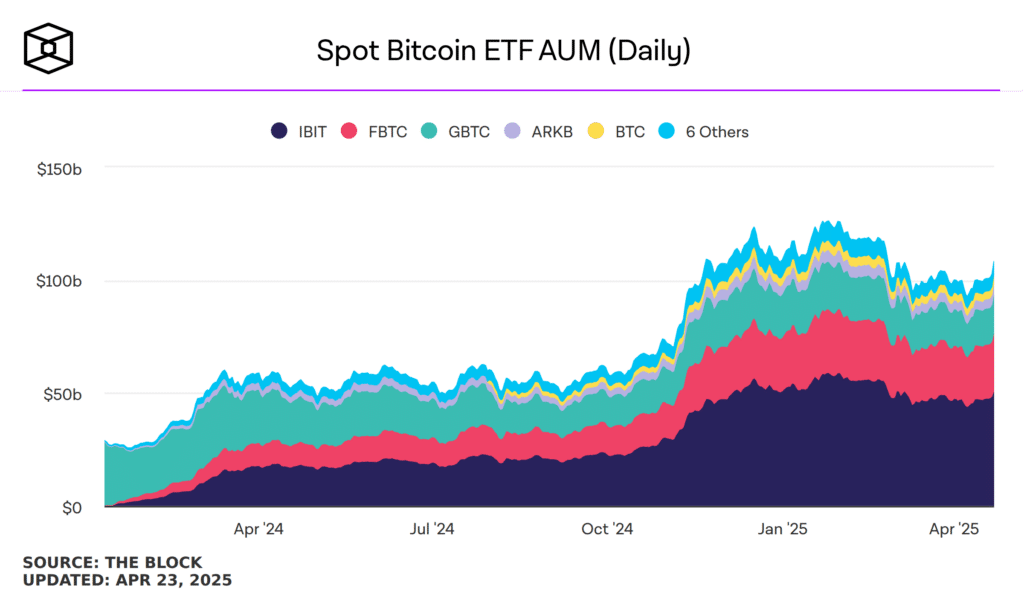

Bitcoin ETFs have made a remarkable recovery, bouncing back from nearly $17 billion in losses earlier this year. This rebound is attributed to a combination of significant inflows and a surging Bitcoin price.

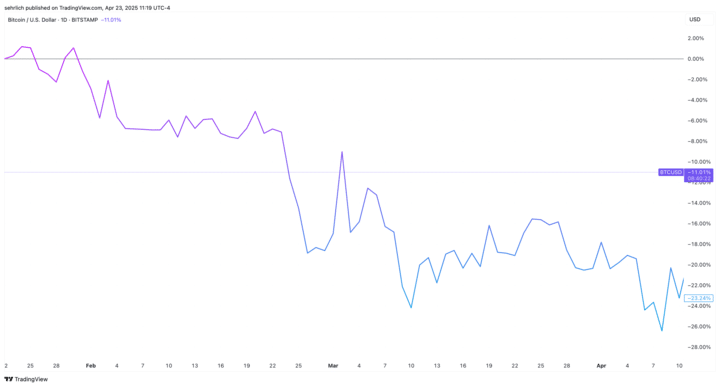

Bitcoin kicked off 2025 with optimism following President Trump's inauguration, aiming to position the U.S. as a "bitcoin superpower". However, the asset faced a downturn after reaching a peak of $108,786 on January 20, experiencing a 26% drop due to Trump's trade wars and tariff threats.

From January 20 to April 8, Bitcoin ETFs faced their first sustained bearish period, with a staggering $27.5 billion lost. However, as of April 23, the assets under management (AUM) for these ETFs stood at $108.16 billion, almost recovering all losses.

This resurgence is noteworthy as Bitcoin is now down just 0.27% year-to-date, contrasting sharply with traditional equities like the Nasdaq 100, S&P 500, and Dow Jones which remain significantly down.

A Faint Unwind and a Furious Comeback

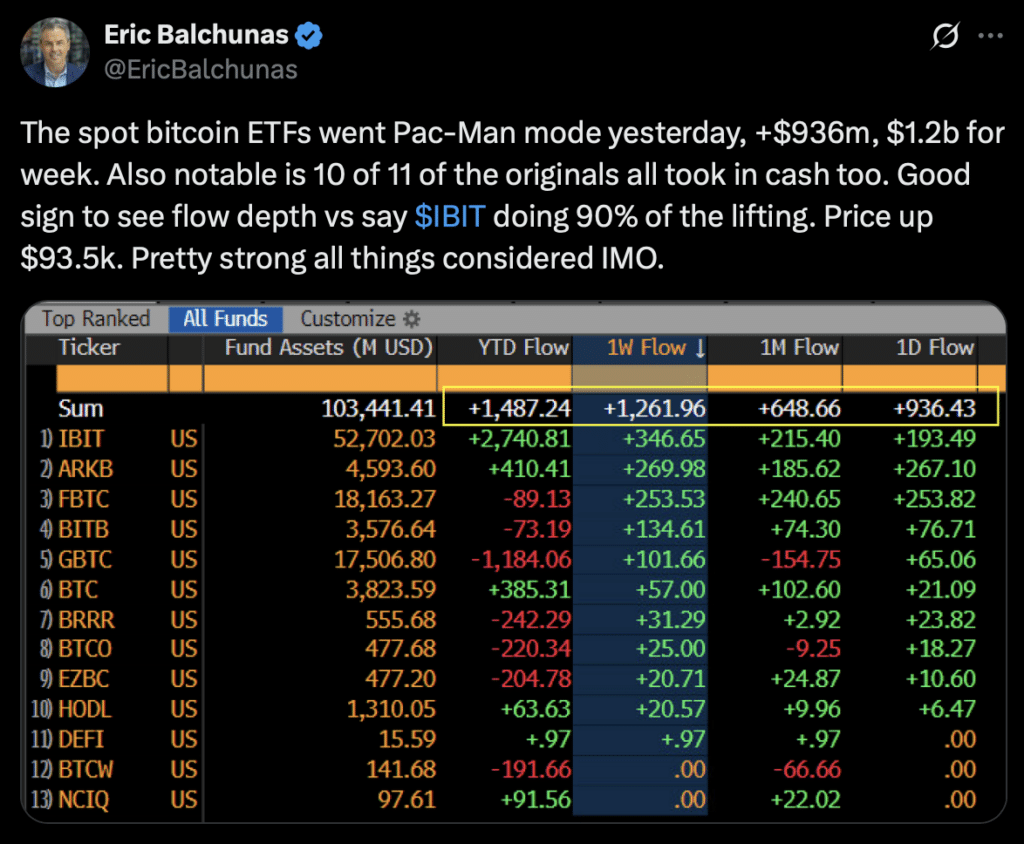

Despite the earlier sell-off, the recovery has been swift. James Seyffart, an analyst at Bloomberg Intelligence, noted that the initial drop was largely due to a basis trade unwind that led to billions being withdrawn from these products. Interestingly, many investors remained committed during the downturn.

Since the pause on tariffs on April 9, spot Bitcoin ETFs have gained $15.66 billion, nearly restoring their previous value.

The peak of this rally occurred on April 22, with $936 million flowing into the ETFs within a single day, contributing to over $1.6 billion in inflows for the week.

One Mountain Left to Climb

Although Bitcoin ETFs are on the mend, they still need to recover to their all-time high of $126.1 billion reached on January 25, requiring an additional $17.94 billion. Achieving this will depend on positive developments such as Trump's recent assurance not to dismiss Federal Reserve Chairman Jerome Powell, alongside progress in trade negotiations and easing tensions with China.

Don’t Miss This Week’s Episode of Bits+Bips!

Read more: Why Trump-Induced Stagflation Could Finally Make Bitcoin a Safe Haven

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!