Summary:

Bitcoin has slipped below $57,000, currently trading at $56,794.

Many short-term holders are facing unrealized losses, raising concerns of market volatility.

The $51,000 price level is critical support for the current market structure.

Average short-term holder cost basis ranges from $59,000 to $65,200.

Long-term investors are in a more stable position, slowing profit-taking activities.

Bitcoin has struggled to maintain its position above $58,000, dropping to $56,700 on Thursday morning and trading relatively flat throughout the day. As per data from CoinGecko, the current price stands at $56,794, reflecting a 0.6% increase over the past 24 hours but a 4.7% decline for the week.

Despite Bitcoin being nearly 20% below its all-time high, new analyses indicate a rising risk factor in the crypto market. Short-term holders, many of whom are facing unrealized losses, pose a potential threat of significant market volatility if they choose to sell off their holdings.

Although the average Bitcoin investor remains profitable, recent entrants into the market, particularly those who acquired Bitcoin in the last six months, are experiencing considerable unrealized losses. This dynamic could lead to a volatile environment that affects the broader crypto market.

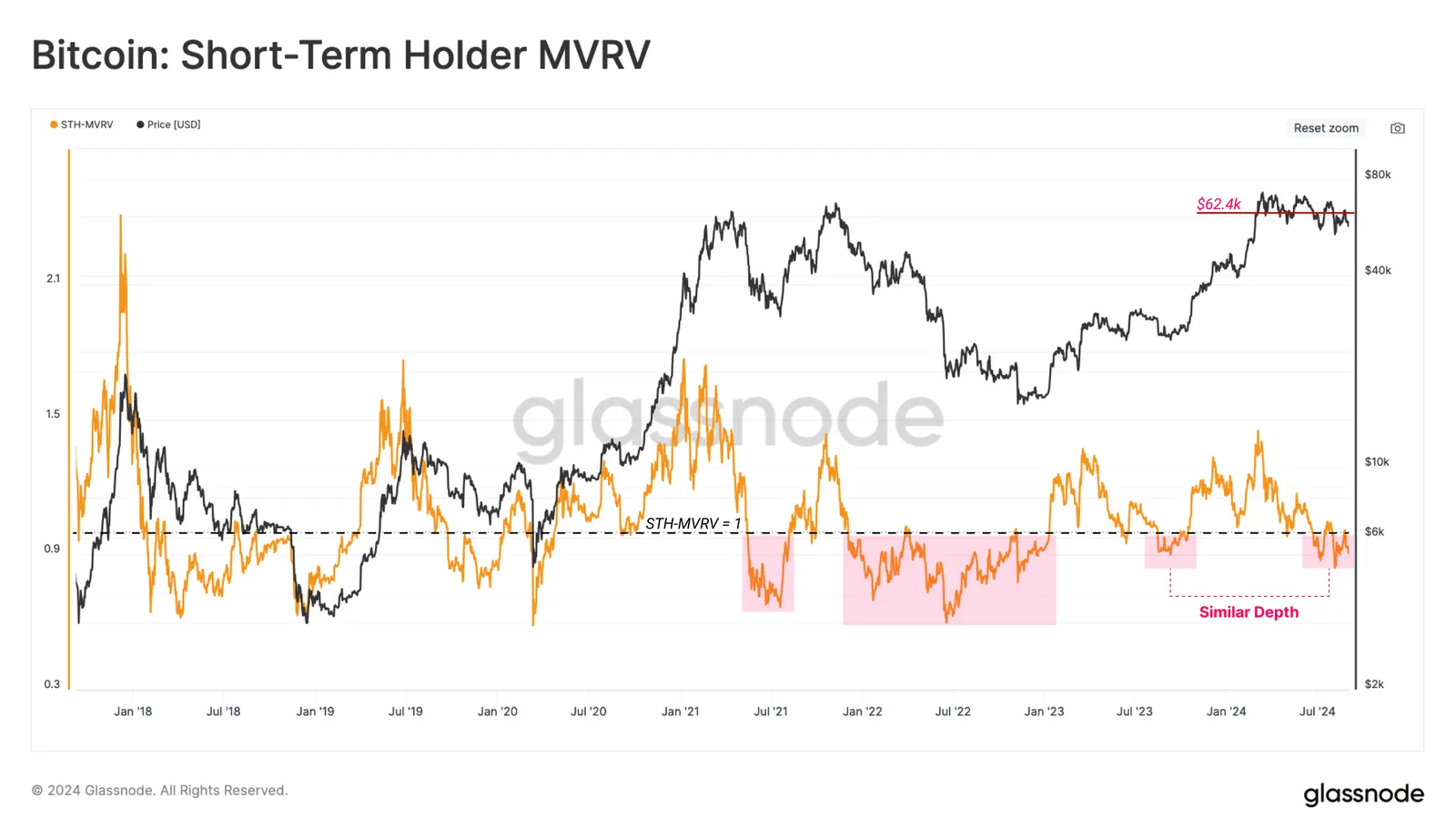

According to a report from blockchain intelligence firm Glassnode, the Short-Term Holder cohort is currently heavily underwater on their investments, creating a risk factor. The report highlights that their unrealized losses are dominating the market landscape, and warns that stability could be compromised if these holders decide to exit their positions en masse. The $51,000 price level is identified as crucial support that must be maintained to safeguard the current market structure.

The analysis notes that short-term holders' unrealized losses have been on the rise for several months, with all age bands within this group, from those holding for just one day to those with up to six months of holding, currently in the red. The average cost basis for these investors ranges from $59,000 to $65,200, significantly above current prices.

This situation is reminiscent of the tumultuous market conditions of 2019, but it still poses a considerable risk. The report suggests that unless Bitcoin's spot price reclaims the Short-Term Holder cost basis of $62.4k, further market weakness is expected.

Image: Glassnode

Image: Glassnode

The stress experienced by short-term holders is expected to have broader implications, potentially triggering market volatility due to their selling pressure, especially considering the current low levels of overall profit and loss-taking activities.

Interestingly, while short-term holders face losses, long-term investors seem more stable, having slowed their profit-taking activities. Coins accumulated during the recent all-time high run are gradually maturing into long-term holdings.

Comments