Summary:

Bitcoin broke above its descending trendline, suggesting bullish momentum ahead.

If the trendline holds as support, BTC could rally 9% towards $63,956.

Momentum indicators RSI and AO must stay above their mean levels to support the recovery.

Ethereum broke above the $3,240 level, potentially leading to an 8.8% rise towards $3,524.

Ripple breached the daily resistance level of $0.499, indicating a potential bullish trend.

If XRP closes above $0.532, it could rally 7.76% towards $0.574.

Bitcoin (BTC) Breaks Above Trendline: Bullish Momentum Awaits

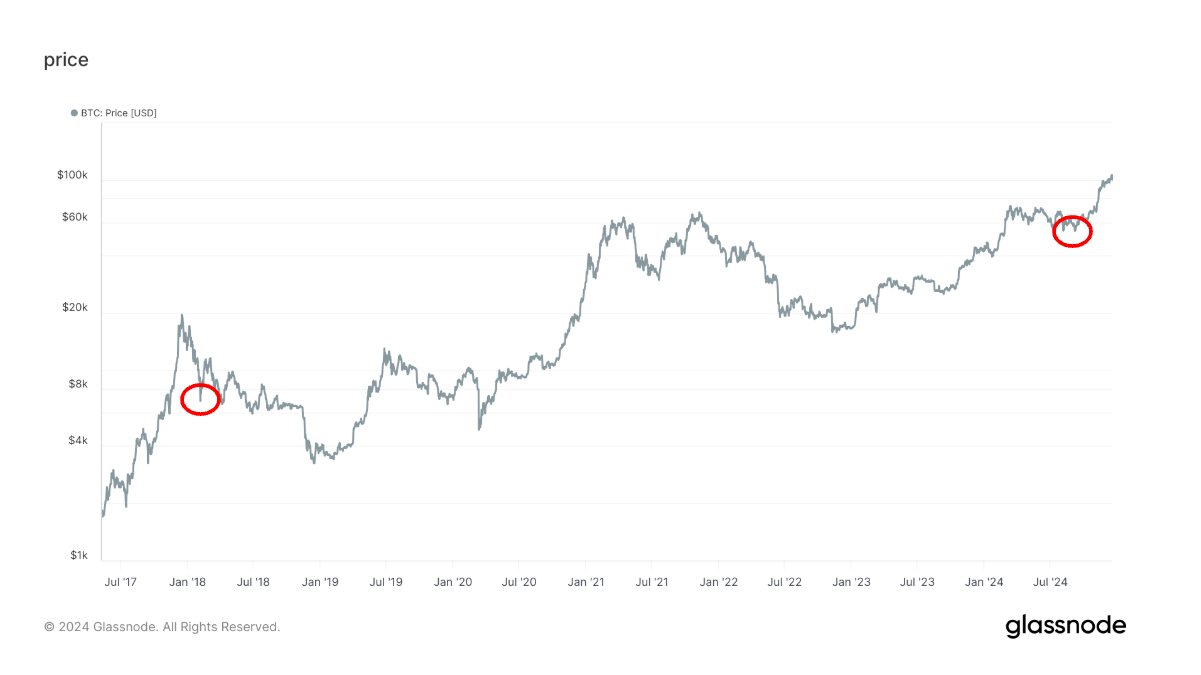

Bitcoin (BTC) experienced a surge on Sunday, exceeding its descending trendline. This breakout suggests a potential bullish momentum for Bitcoin in the near future.

The trendline, connecting swing high levels from early June to mid-July, holds significance for Bitcoin's price direction. If the trendline remains as pullback support around the $58,357 level, it aligns with the weekly support level, potentially driving a 9% rally towards the daily resistance level of $63,956.

Momentum Indicators like the Relative Strength Index (RSI) and Awesome Oscillator (AO) are crucial in confirming this bullish sentiment. These indicators must maintain their positions above their mean levels to support the recovery rally.

Bearish Scenario: If Bitcoin closes below $56,405 and forms a lower low in the daily timeframe, it may signal persistent bearish sentiment. This scenario could trigger a 7.5% decline, targeting a revisit of its daily support at $52,266.

Ethereum (ETH) Surges Above Resistance: Bullish Structure Shifts

Ethereum's price also witnessed a bullish move, breaking above the $3,240 level on Sunday. If this level holds as support, ETH could see an 8.8% rise, targeting a retest of its daily high from July 1 at $3,524.

Similar to Bitcoin, momentum indicators, RSI and AO, need to maintain their positions above their mean levels to support the bullish narrative.

Aggressive Scenario: If the bulls are aggressive, and the overall crypto market outlook is positive, Ethereum could extend its rise by 5.5%, retesting its daily high of $3,717 from June 9.

Bearish Scenario: If Ethereum's daily candlestick closes below $2,817, it may signal persistent bearish sentiment, potentially leading to a 7% decline towards its daily support at $2,621.

Ripple (XRP) Breaks Resistance: Bulls Look Promising

Ripple (XRP) breached the daily resistance level of $0.499 on Saturday. Currently, it faces resistance around the $0.532 daily high level from June 5. If XRP closes above $0.532, it could rally 7.76% to retest its daily resistance level of $0.574.

Both the RSI and AO are positioned above their critical thresholds, indicating bullish dominance.

Strong Bullish Scenario: Surpassing the $0.574 level could pave the way for an additional 12% rally to retest the next daily high at $0.643.

Bearish Scenario: If Ripple's daily candlestick closes below $0.413, it could lead to a 16% decline, targeting a revisit of its low from March 12 at $0.347.

Remember: This analysis is based on technical indicators and historical data. Investing in cryptocurrencies carries significant risk, and it's crucial to conduct thorough research before making any investment decisions.

Comments