Summary:

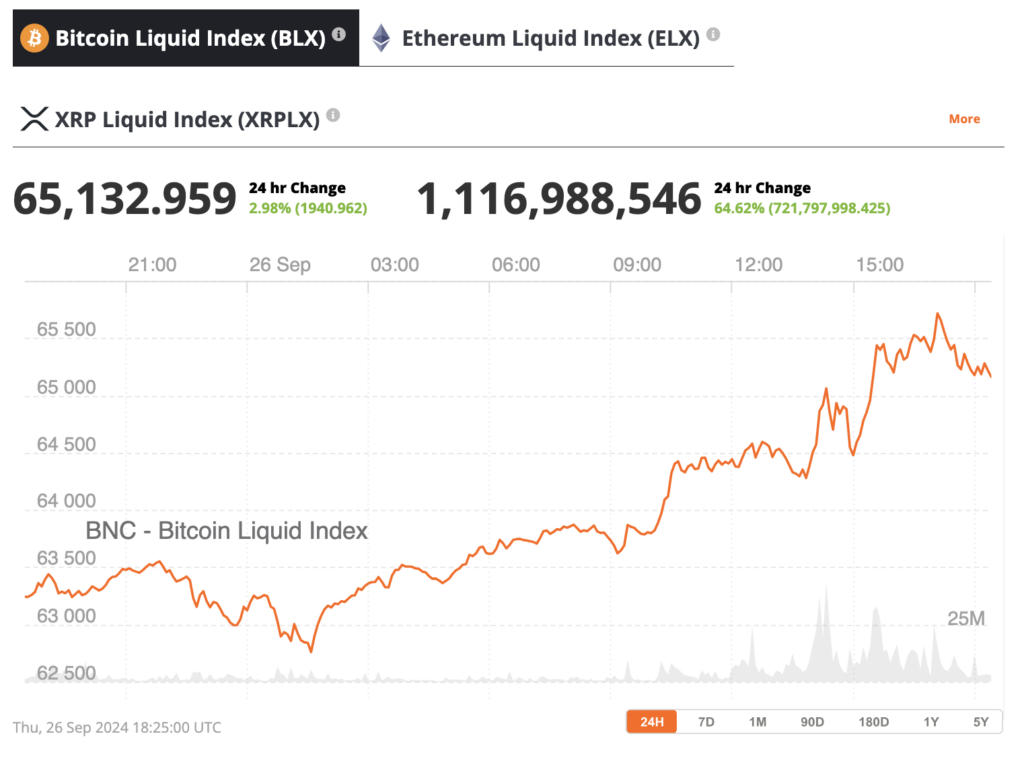

Bitcoin surged above $65,500, the highest in nearly two months.

Market sentiment is bullish following the U.S. Federal Reserve's interest rate cut.

BlackRock’s iShares Bitcoin Trust saw inflows of nearly $185 million.

Retail investors have accumulated 35,000 BTC in the past month.

Over 40,000 BTC withdrawn from exchanges, reducing liquidity.

Bitcoin has made a significant leap, surpassing $65,500 for the first time in nearly two months, signaling a bullish market sentiment among traders. This surge comes on the heels of the U.S. Federal Reserve's decision to cut interest rates by 50 basis points, which has traders speculating on further cuts in the upcoming Fed meeting on November 7.

Key Factors Driving Bitcoin's Rally:

- The recent surge has reignited interest in U.S.-based spot Bitcoin ETFs, with BlackRock’s iShares Bitcoin Trust (IBIT) seeing inflows of nearly $185 million on Wednesday, following a previous influx of $98.9 million.

- Economic developments in China are also influencing the market, with reports of a potential 1 trillion yuan ($142 billion) injection into state banks to stimulate economic growth, which has positively impacted both the Shanghai Composite Index and U.S. markets.

September Accumulation

Over the last month, Bitcoin's ecosystem has seen notable accumulation, with approximately 88,000 BTC acquired on a net basis. This intense buying activity, predominantly from retail investors, has not been observed since Q4 2023. Notably, smaller holders, referred to as “crabs” and “shrimps,” have accumulated 35,000 BTC in the past month, reflecting increased confidence in the market.

Additionally, over 40,000 BTC have been withdrawn from exchanges, reducing liquidity and suggesting long-term holding intentions among investors. This accumulation trend, coupled with 74% of the circulating supply being illiquid, fosters a bullish environment for potential future price increases.

A Gamma Squeeze?

The SEC has approved the listing of physically settled options linked to BlackRock’s spot Bitcoin ETF, which could attract more institutional investors. However, opinions vary on how this will impact Bitcoin's volatility.

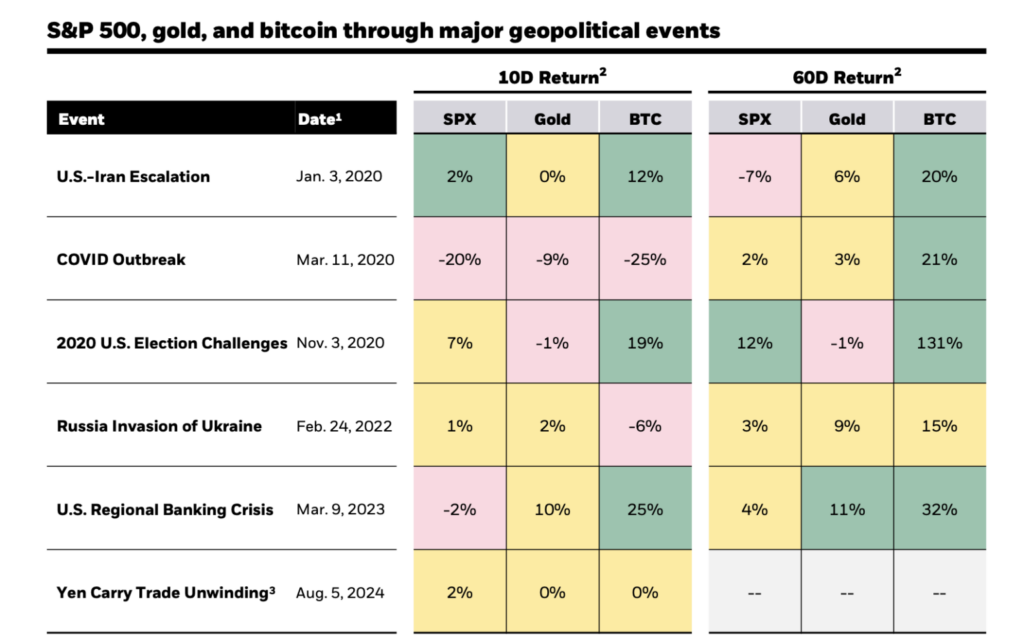

Robbie Mitchnick, BlackRock’s head of digital assets, clarified misconceptions about Bitcoin being labeled a “risk-on” asset, emphasizing its distinct long-term drivers compared to equities. He highlighted Bitcoin's potential as a “unique diversifier” and a hedge against various risks, noting its resilience during geopolitical events.

Source: BlackRock

Comments