Bitcoin's On-Chain Metrics Indicate Potential Sideways Movement or Correction

Recent on-chain metrics from the analytics firm Glassnode suggest that Bitcoin (BTC) may be facing a period of sideways movement or potentially more corrections due to weakening buying pressure.

According to Glassnode, the short-term demand momentum for BTC has significantly diminished. They noted on the social media platform X that:

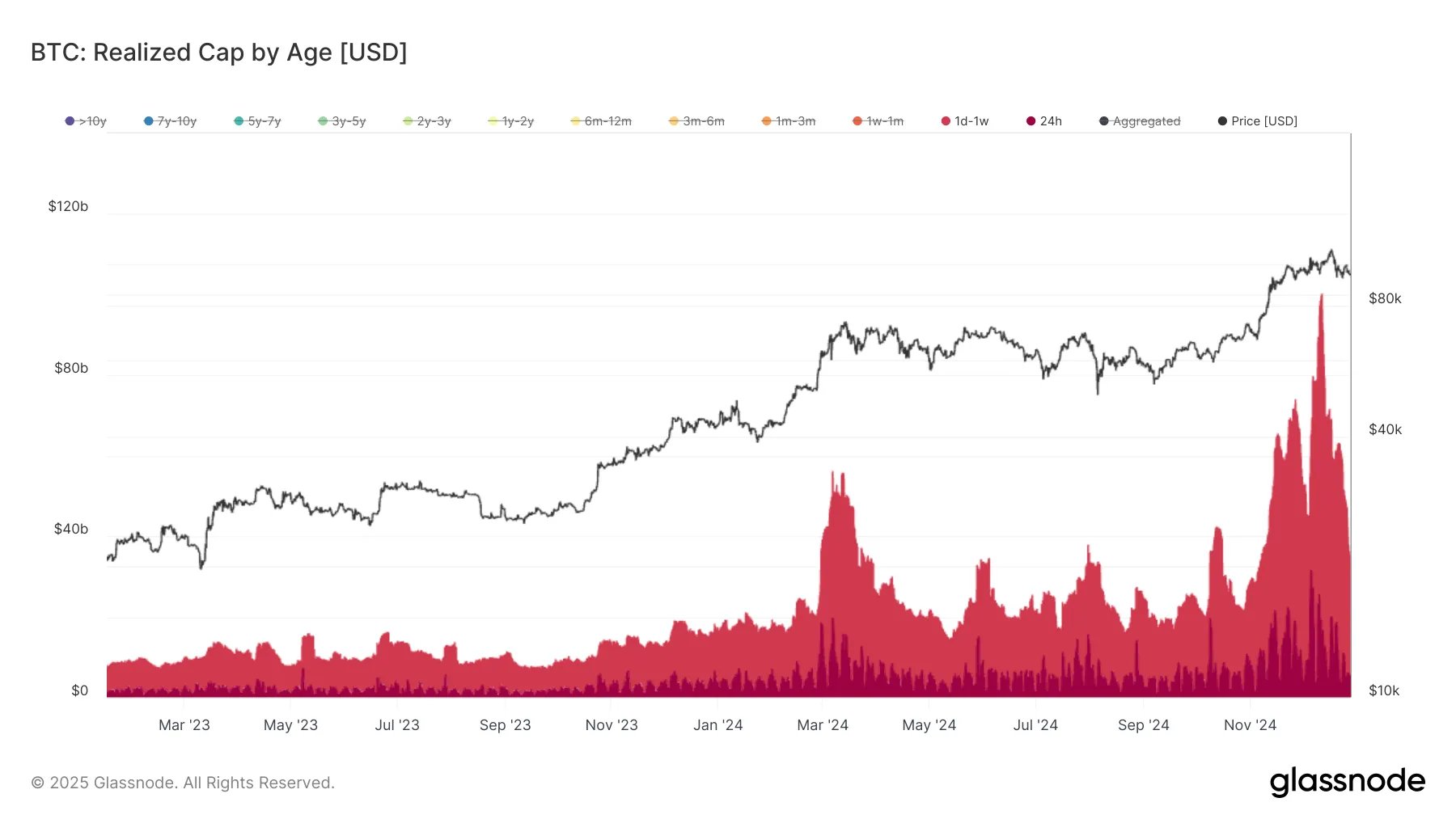

"One key indicator: Hot Capital (capital revived over the last 7 days) has plunged 66.7% from its December 12th peak of $96.2 billion to $32.0 billion."

Furthermore, the firm highlights that:

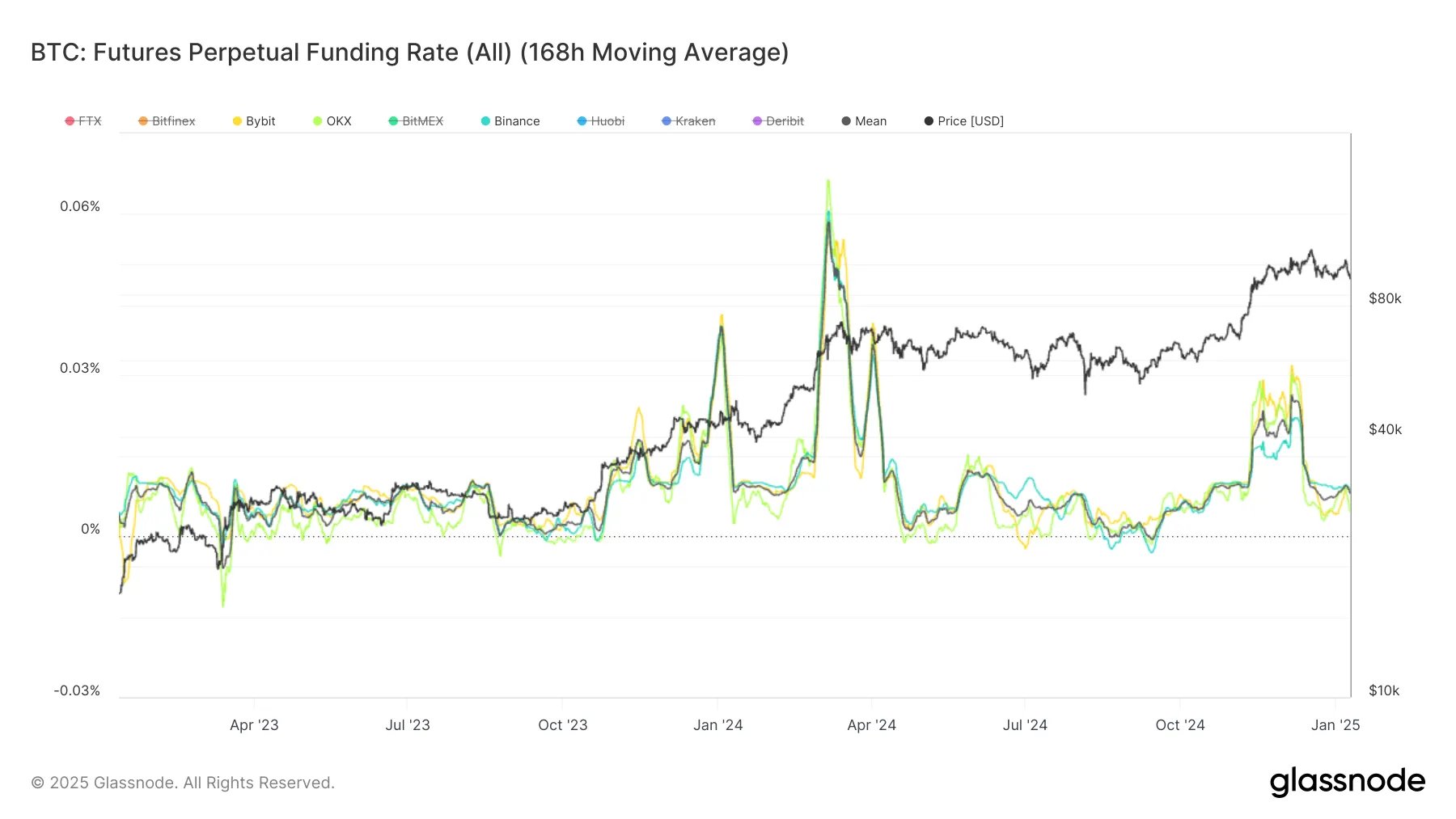

- Diminished exchange volume momentum and low funding rates are also indicative of reduced demand.

- The 30-day average of exchange volume is approaching the 365-day average, showcasing reduced capital flows since the December market peak.

- The seven-day moving average of the mean funding rate remains below the neutral value of 0.01%, indicating a lack of demand from aggressive buyers, despite a brief rally towards $102,000.

"Without a new catalyst, the waning short-term demand suggests either a sideways consolidation period or a heightened likelihood of further correction."

As of now, Bitcoin is trading at $92,579, reflecting a 3% decline over the past 24 hours and more than 4% over the last seven days. It also remains over 14% down from its all-time high of $108,135 set in December.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!