Summary:

AMP Ltd. invests A$27 million in Bitcoin futures, marking a significant move in Australia's pension sector.

Bitcoin recently surpassed $100,000, gaining over 40% since the US election.

AMP's investment represents about 0.05% of its total pension assets, reflecting cautious optimism in digital assets.

The Australian pension industry has shown little enthusiasm for crypto investments, despite AMP's bold step.

Regulatory authorities emphasize the need for robust risk management in digital asset investments.

AMP Ltd. Takes a Leap into Bitcoin Futures

Australian pension and wealth firm AMP Ltd. has made headlines by becoming one of the first large retirement managers in the nation to invest in cryptocurrency products. The firm has allocated approximately A$27 million ($17.2 million) to Bitcoin futures.

AMP Senior Portfolio Manager Steve Flegg announced this decision in a LinkedIn post, indicating that the fund has "taken the plunge" into Bitcoin. A spokesperson confirmed that the investment is specifically in Bitcoin futures and stated there are currently no plans to increase this allocation.

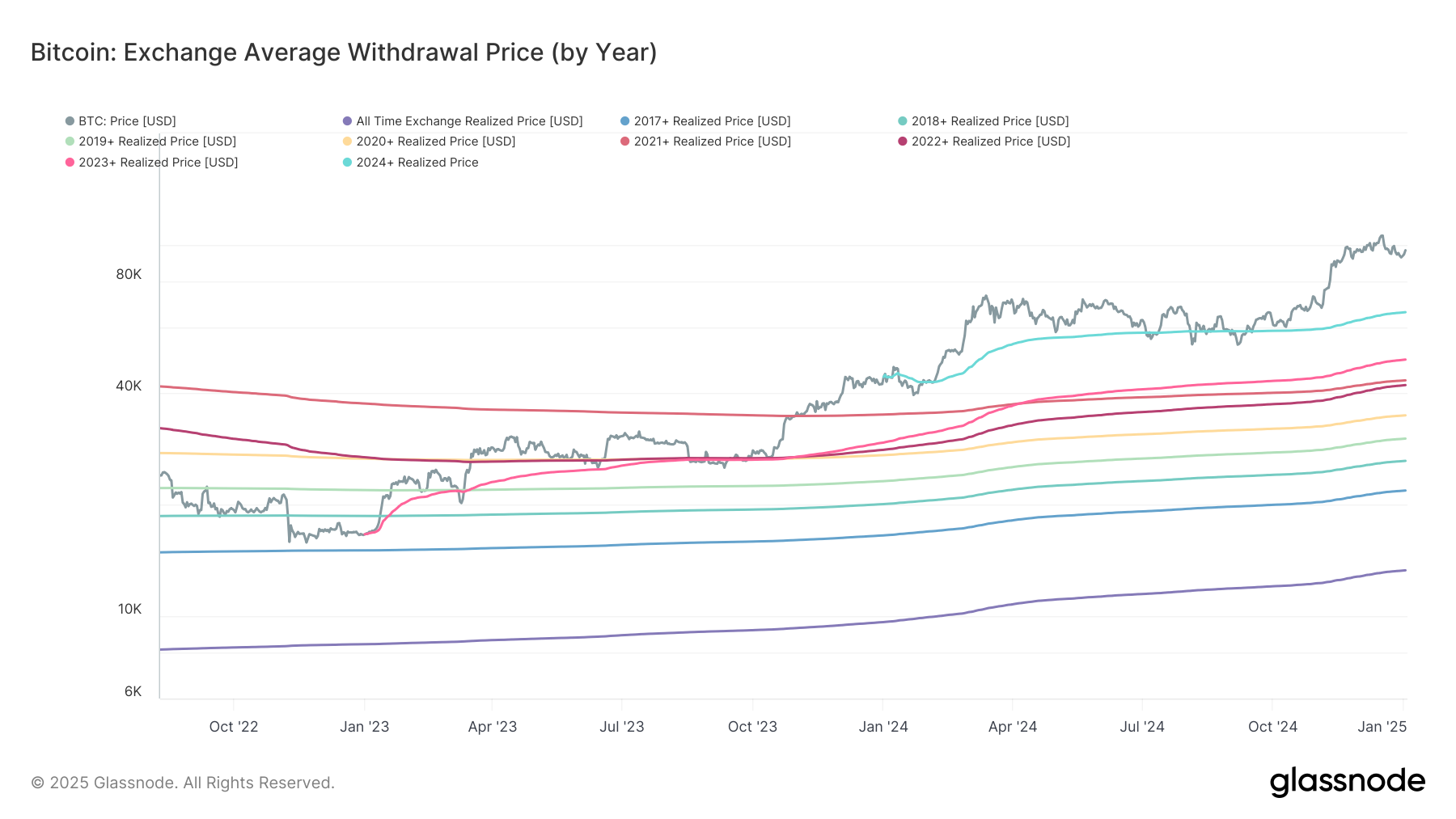

Bitcoin's Recent Surge

Recently, Bitcoin exceeded $100,000 for the first time, reflecting a 40% increase since Donald Trump's victory in the November US Presidential election. Trump's pro-crypto stance aims to create a supportive environment for digital asset firms in the United States.

However, the Australian pension system, valued at A$4.1 trillion, has been cautious regarding cryptocurrency investments. Reserve Bank of Australia Governor Michele Bullock commented that Bitcoin has no significant role in the Australian economy. Furthermore, the prudential regulator has stressed the need for "robust risk management controls" when dealing with digital assets.

Industry Context

AMP's investment comes amid scrutiny of Australia’s pension sector regarding various issues, including unlisted market valuations, customer service, and investment fees. The industry undergoes an annual performance test to eliminate underperforming retirement products, with many offered by AMP failing this test for two consecutive years.

Strategic Shift in Digital Assets

According to AMP’s Chief Investment Officer Anna Shelley, this investment acknowledges the structural changes in the digital-assets industry over the past year, including the launch of exchange-traded funds that invest directly in Bitcoin and Ether by leading investment managers. After thorough testing and consideration, AMP decided to integrate a small and risk-controlled position in digital assets through its Dynamic Asset Allocation program in May, which constitutes about 0.05% of its total pension assets.

The Australian Prudential Regulation Authority did not comment on AMP’s investment but referred to a 2022 letter addressing the financial sector’s stance on digital assets.

Comments