Summary:

U.S. economy expected to end 2024 stable despite political turmoil.

Inflation has significantly decreased, but the outlook for 2025 is uncertain.

S&P 500 reached record highs, driven by major tech stocks.

Federal Reserve cut rates, but inflation risks remain a concern.

Bitcoin surged to $100,000, following Trump's victory, showcasing its volatility.

Despite the tumultuous U.S. presidential campaign and global conflicts, the economy is expected to end 2024 on a stable note. Inflation has significantly decreased, and the U.S. economic growth remains robust. However, 2025's outlook is uncertain due to President-elect Donald Trump's policy changes.

Rate cuts, stock surges, and Trump’s tariff threats are among the biggest forces shaping business and the economy.

Rate cuts, stock surges, and Trump’s tariff threats are among the biggest forces shaping business and the economy.

Banner Year for Stock Market

As of January 2024, the S&P 500 reached new highs, largely propelled by the “Magnificent Seven” tech stocks: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. The index recorded 57 record highs throughout the year.

Anticipation High for Cuts

The global cooldown in inflation has led to expectations of easing monetary policies. The Federal Reserve cut rates significantly for the first time since the pandemic, indicating a shift towards protecting the job market.

A Rise in Uncertainty

Despite rate cuts, inflation risks remain. The Fed's recent announcements suggested only two rate cuts by the end of 2025, causing market volatility.

A Less-Optimistic Story

Following Fed news, 10-year Treasury yields surged, indicating investor concerns about future inflation and a potential increase in federal deficits due to Trump's policies.

Trump’s Tariff Threats

Trump plans to impose tariffs on imports from Canada, Mexico, and China, which could trigger a trade war and potentially higher inflation for American consumers.

A Divided Economic Outlook

Consumer sentiment diverges sharply between Republicans and Democrats, with Republicans optimistic about reduced inflation and Democrats fearing inflationary pressures from tariffs.

A Crypto Resurgence

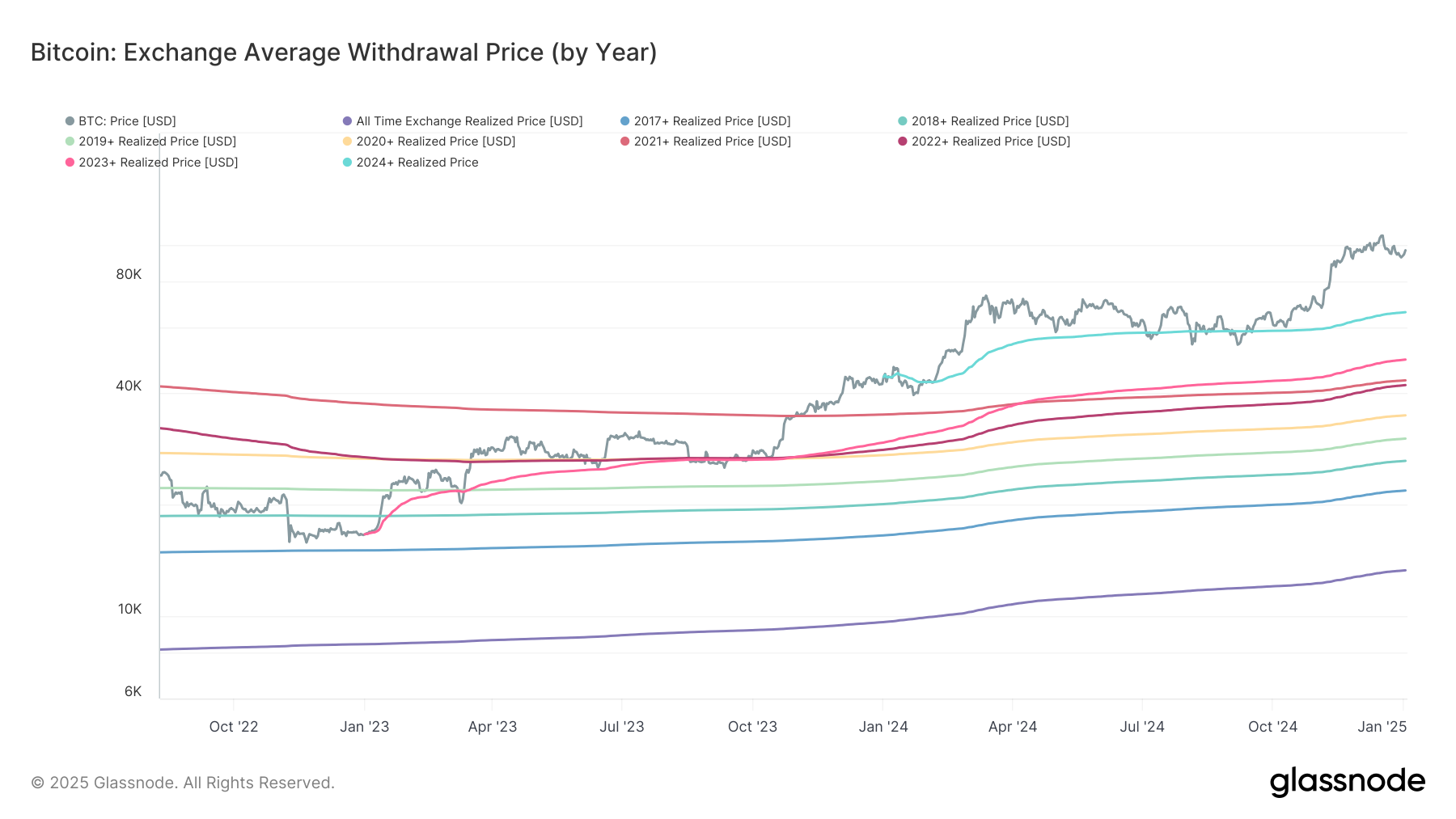

The cryptocurrency market has thrived alongside Trump's victory, with Bitcoin reaching $100,000, a dramatic recovery from its drop below $17,000 in 2022. However, Bitcoin's volatility raises questions about its stability as a currency.

AI Fueled Astronomical Growth

Nvidia has significantly benefited from the crypto boom, with its shares soaring over 800% since early 2023. The company is pivotal in both the gaming and AI sectors, which have seen explosive growth.

The Future of Mergers

After a slump, Mergers & Acquisitions are slowly recovering, with optimism that a Trump presidency could facilitate deal-making, despite potential regulatory challenges.

— This article originally appeared in The New York Times.

Comments